Dimensions Equity—A Risk Worth Taking

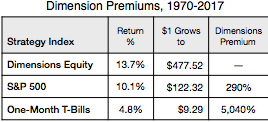

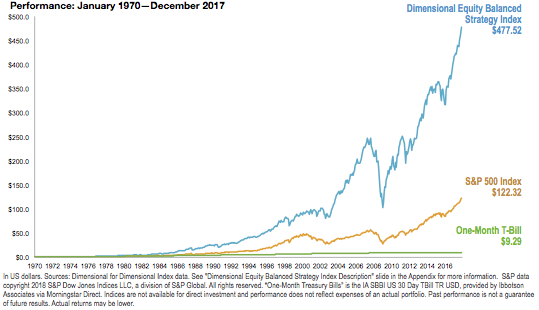

The graphic compares the 48-year performance of the Dimensions Equity Strategy to the S&P 500 Index used as the equity in a portfolio. Also compared are One-Month T-Bills, the lowest-risk investment. We use the S&P 500 as a benchmark because it tends to be what most people relate to as ‘the market.’ And it’s a fact that there have been multi-year periods when the S&P 500 outperformed the Dimensions Equity strategy. Therefore it’s reasonable to question the approach. What we know is that the historical evidence and the rationale outlined below supports the approach.

Rationale for Dimension Premiums

Stocks of small companies, value companies, and high profitability companies have discount rate characteristics that create price opportunities that have led to premiums over alternative benchmarks—over time. There are no low risk/high expected return investments. Here’s why: If an investment offered a disproportionately high return for the risk (volatility) involved, word would quickly spread and others would try to capitalize on the information. This additional demand would result in the price of the investment being driven up to the point where its expected return is comparable with other investment of similar risk.